The $300M Heist Just Got Smarter

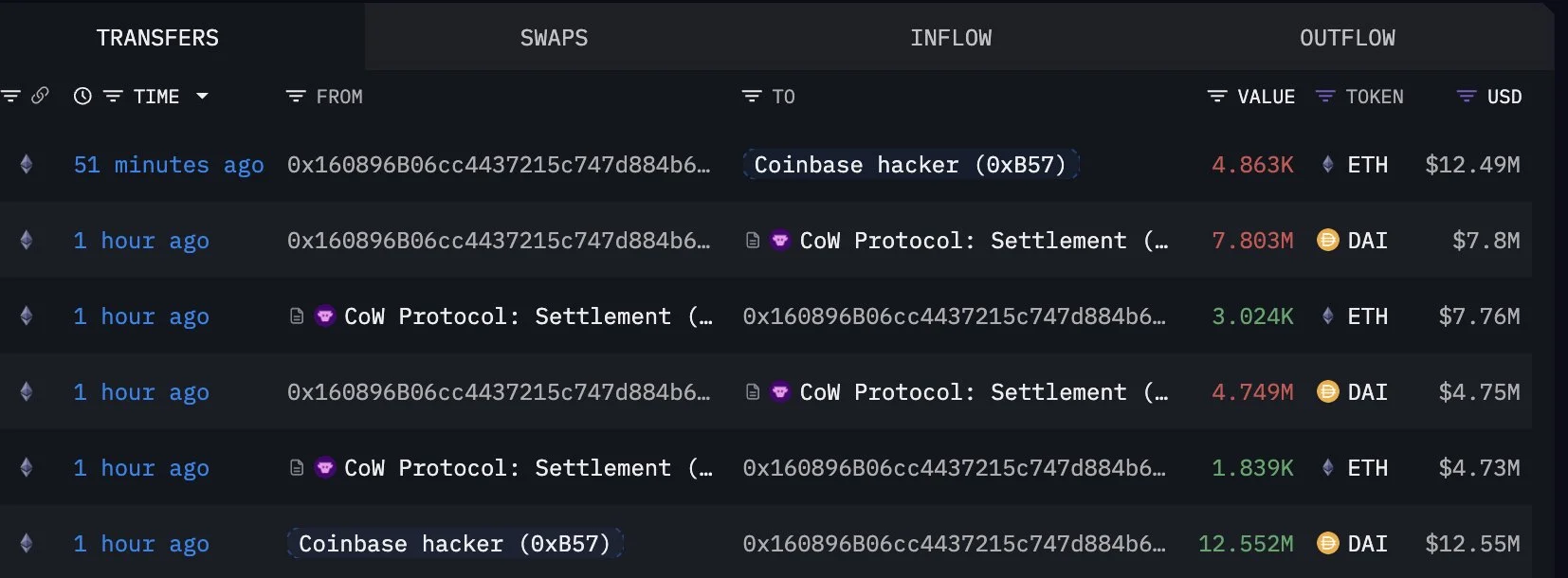

In a brazen financial dance, the hacker responsible for stealing over $300 million from Coinbase users executed two strategic Ethereum moves:

- Two months ago, they dumped 26,762 ETH ($69.25M) at $2,588 per coin

- Hours before this report, they bought 4,863 ETH ($12.55M) at $2,581

Blockchain analysts at Lookonchain spotted these transactions, revealing what experts call a “chip-and-dip” strategy to launder stolen crypto.

Coinbase's Counterattack: Bounties & Security Upgrades

While the hacker plays markets, Coinbase is fighting back:

✓ Rejected $20M ransom, offered $20M bounty for arrests

✓ Deployed US only support hubs and real-time scam alerts

✓ Committed $400M for victim reimbursements - praised by TRM Labs as industry gold standard

Crypto's Growing Security Crisis

This breach reflects industry wide vulnerabilities:

- $2.47B stolen in H1 2025 - already surpassing 2024's total

- Ethereum most targeted chain: $1.5B stolen in 164 attacks

"Cross-chain bridges turn crypto into a thief's playground"

notes blockchain analyst Lena Jiang. "Tracing funds becomes impossible once they jump to Ethereum or Avalanche."

3 Critical Steps for Investors

1. Enable multi-factor authentication - especially SMS-based codes

2. Monitor official breach updates for reimbursement claims

3. Treat unsolicited "support" calls as red flags - the original hack used social engineering